2009 Q2

Second Quarter 2009

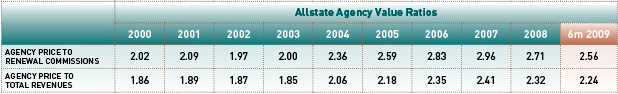

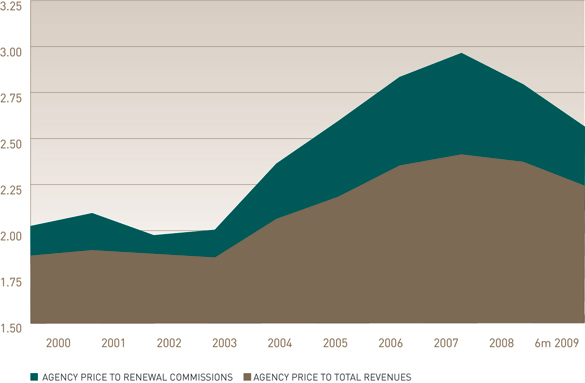

In the previous Fourth Quarter 2008 and First Quarter 2009 Allstate Agency Value Index reports it was noted that the sharp decline in Agency value relative to renewal commissions and total revenues reported for the fourth quarter of 2008 was likely an anomaly in terms of the rate of decline, but spot on in terms of reflecting the general downward movement of Agency value. With the release of the Second Quarter 2009 Agency value ratios, this view is supported by the six months of 2009 Allstate Agency sales data, which reflects a downward trend in Agency value but a more gradual decrease than the fourth quarter 2008 results alone would suggest. As previously noted, it seems that the values for which Allstate Agencies were sold during the fourth quarter 2008 were heavily influenced by the desires of sellers to complete their deals before the end of the year. In other words, compromises on Agency value occurred in order to speed up closings as sellers sought to avoid the uncertainties of a new tax year, new administration and turbulent economic environment.

The general decline in Agency value from the first quarter of 2008 to the second quarter of 2009 has been relatively sharp. However, given the sharp decline in the U.S. and world economies, and the equally sharp decline in the value of stocks, commercial real estate, and residential real estate, we do not find this either shocking or disturbing. In fact, it is anticipated that the value for which an Allstate Agency is sold for relative to its renewal commissions and total revenues may be very near a base at the 2.50 and 2.22 levels reported for the second quarter 2009.

Allstate Agencies sell a basic needs product, are supported by a high-profile brand name, have very low overhead and a relatively large number of prospective buyers, and are backed by Allstate Insurance as a 1.5 to 1 buyer of last resort. This is a powerful combination of factors, which have and should continue to manifest in strong Allstate Agency value. However, for any Allstate Agency owner to fully realize the value of his or her Agency, the accumulation of savings from the ample Agency earnings over the years preceding the sale of the business is critical. In fact, the value realized from the sale of the agency should be the cherry on top of an already very healthy personal financial statement.

Historical Allstate Agency Value

Viewed over the long term, the present value for which Allstate Agencies are being sold remains strong relative to both Agency renewal commissions and total revenues. This is a testament to the extremely strong historic earnings of Allstate Agencies and the relatively stable nature of their revenues. An additionally significant and interesting aspect of Allstate Agency value that can be observed in the long-term historical agency sales data is the impact an Allstate Agency’s size has on its value relative to renewal commissions.

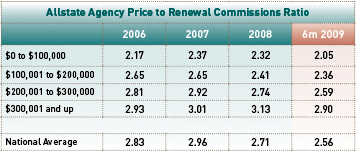

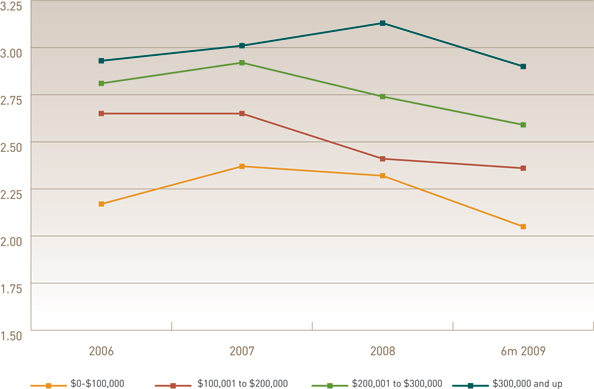

As noted in the First Quarter 2009 Allstate Agency Value Index, the inclusion of Allstate Agency sales prices relative to renewal commissions has been updated for the first six months of 2009 (see chart below).

Agency Price to Renewal Commission

Based on Allstate Agency sales data accumulated over the last three-plus years, it’s clear that size matters to buyers as those agencies with renewal commissions of $300,001 or greater sell for the largest multiple of commissions. In fact, the data shows that the commissions multiple decreases steadily in line with the decrease in the size of the Allstate Agency. Interestingly, agencies with renewal commissions in the range of $200,001 to $300,000 have been sold for a multiple, which is very much in line with national average multiple for Allstate Agency sales.

The reason this trend of higher multiples paid for larger revenues streams is found in the buyer’s “post-acquisition wallet.”

As seen in the comparative model shown above, the same buyer will realize greater net personal earnings buying agency “B” even at a considerably higher multiple.